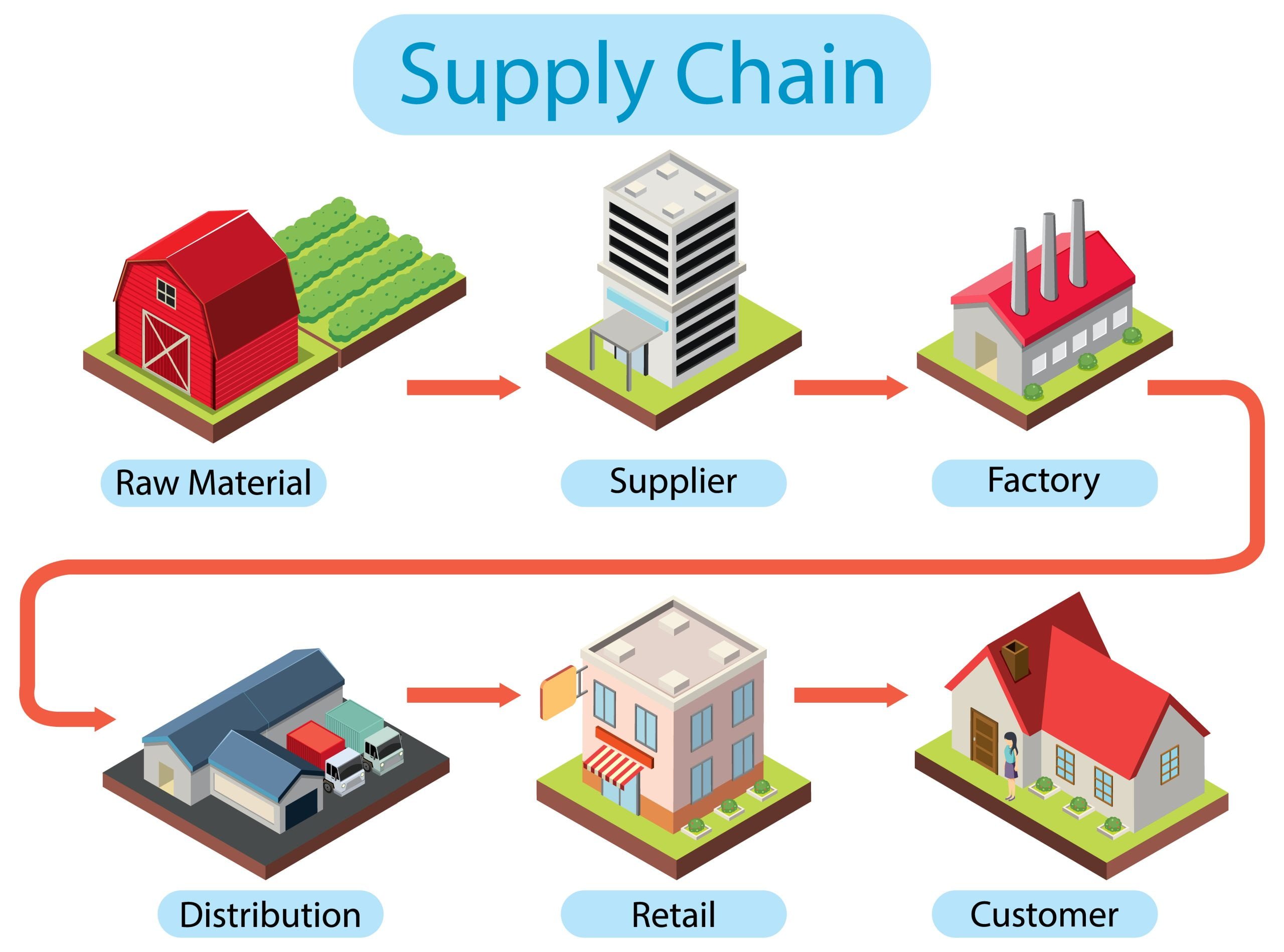

Post-Pandemic Fabrication Supply Chain

The COVID-19 pandemic had led to the disruption of the fabrication and manufacturing supply chain. First came the supply shock, where many fabricators dealt with canceled orders not from lack of demand but because manufacturers could not get other needed parts for the final product. Then came the second punch, this time on the demand side, as unemployment spiked dramatically. manufacturers reacted by reducing or halting orders altogether. Now that the severity of the pandemic has considerably diminished, there is expected to be an evolution of the metal fabrication supply chain. There may be new trends and factors coming up in this regard, and this blog will look to deep-dive into this topic.

Transparency

Supplier management and optimization is a critical requirement in supply chain management since one would want the plumbing set up for multiple supply chains so that one can turn on the faucet here or there, depending on the timing. To do that in some cases, manufacturers reduced the number of faucets (suppliers) to just a few large, highly reliable ones. This in part has helped make some of the largest heavy steel manufacturing companies even larger. The COVID-19 crisis might spur more dual sourcing. If the disease reemerges in a certain locale and everyone at a certain plant needs to go home, will another supplier elsewhere be able to pick up the slack? Such dual sourcing might add a bit of supply chain complexity which is a challenge facing the metal fabrication industry. It goes back again to supply chain transparency, not just between a fabricator and its customer, but also wherever value is added within the entire supply chain. Manufacturers might accomplish this in various ways, one of them being by contracting directly with the lower-tiered suppliers, including metal fabricators. Fabricators might still send welded components to an assembler, which then sends them on to the manufacturer. But the assembler might act simply as a toll processor. In this sense, the supply chain would evolve into a kind of network.

Reshoring and Tracking Financial Health

Overseas work has been coming back from Asia for years, and the steel tariffs of 2018 and the COVID-19 pandemic have accelerated those efforts. According to a survey, 64% of manufacturing and industrial companies are likely to nearshore or reshore because of pandemic-related concerns. In that same survey, 53% of businesses reported difficulty receiving COVID-related supply chain information from their Chinese suppliers. A change in geography does change the risk level, however, supplier location is only a piece of the puzzle. Transparency is still the name of the game. An opaque supplier relationship can have negative consequences, whether that supplier is down the street or an ocean away.

Transparency will include information related not only to where components are in the supply chain, but also the financial health of suppliers. An audit might give a snapshot of a supplier’s liquidity, leverage, efficiency, savings due to process automation, and access to cash. But how will this financial situation change over time? Again, demand for such transparency has been building for years, especially in certain industries.

Make vs. Buy

The COVID-19 pandemic is likely to enable more make-versus-buy analyses and evaluations. The variables in the make-versus-buy decision will remain the same, including available suppliers, shipping logistics, and the nature and mix of products being manufactured. But the potential of disease outbreaks or other external shocks around the globe will lead more companies to further scrutinize their decisions. It is likely that the pandemic will not lead to some massive vertical-integration movement. Bringing in a process that is too far outside a manufacturer’s wheelhouse still will not be practical in many cases. This will be particularly true with processes that require certain expertise, like high-end welding and other specialty fabrication processes such as development of pressure vessels.

The Last Chapter

COVID-19 has tested the agility of industrial supply chains. As the economy picks up in a post-pandemic world, it is essential to ensure that the lessons learnt during those hard times are not lost, but used to drive innovations in supply chains going forward. As the saying goes, a chain is only as strong as its weakest link and supply chains need to iron out their shortfalls to emerge stronger in the long run!